Pussy888 pussy888 ความครบเครื่องของการเดิมพันบนโลกโทรศัพท์มือถือ สร้างรายได้มากมายก่ายกอง

Pussy888 เป็นแพลตฟอร์มคาสิโนออนไลน์ที่นำเสนอเกมสล็อตที่หลากหลาย เป็นที่นิยมในโลกของการพนันออนไลน์เนื่องจากว่าอินเทอร์เฟซที่ใช้งานง่าย การเล่นเกมที่น่าสนใจ แล้วก็โอกาสที่จะชนะเงินจริง นี่คือประเด็นหลักบางประการของสล็อตบน Pussy888 พุซซี่888 มีเกมสล็อตให้เลือกมาก ตั้งแต่สล็อตสามวงล้อคลาสสิกไปจนกระทั่งสล็อตวิดีโอสมัยใหม่ที่มีช่องชำระเงินหลายช่อง คุณลักษณะโบนัส และธีม ผู้เล่นสามารถค้นหาเกมที่ตรงกับความปรารถนาของพวกเขา ไม่ว่าพวกเขาจะเพลินใจกับเครื่องผลไม้แบบเริ่มแรกหรือสล็อตรูปแบบใหม่ๆที่ทำขึ้นมาเพื่อนักพนันทุกกลุ่ม

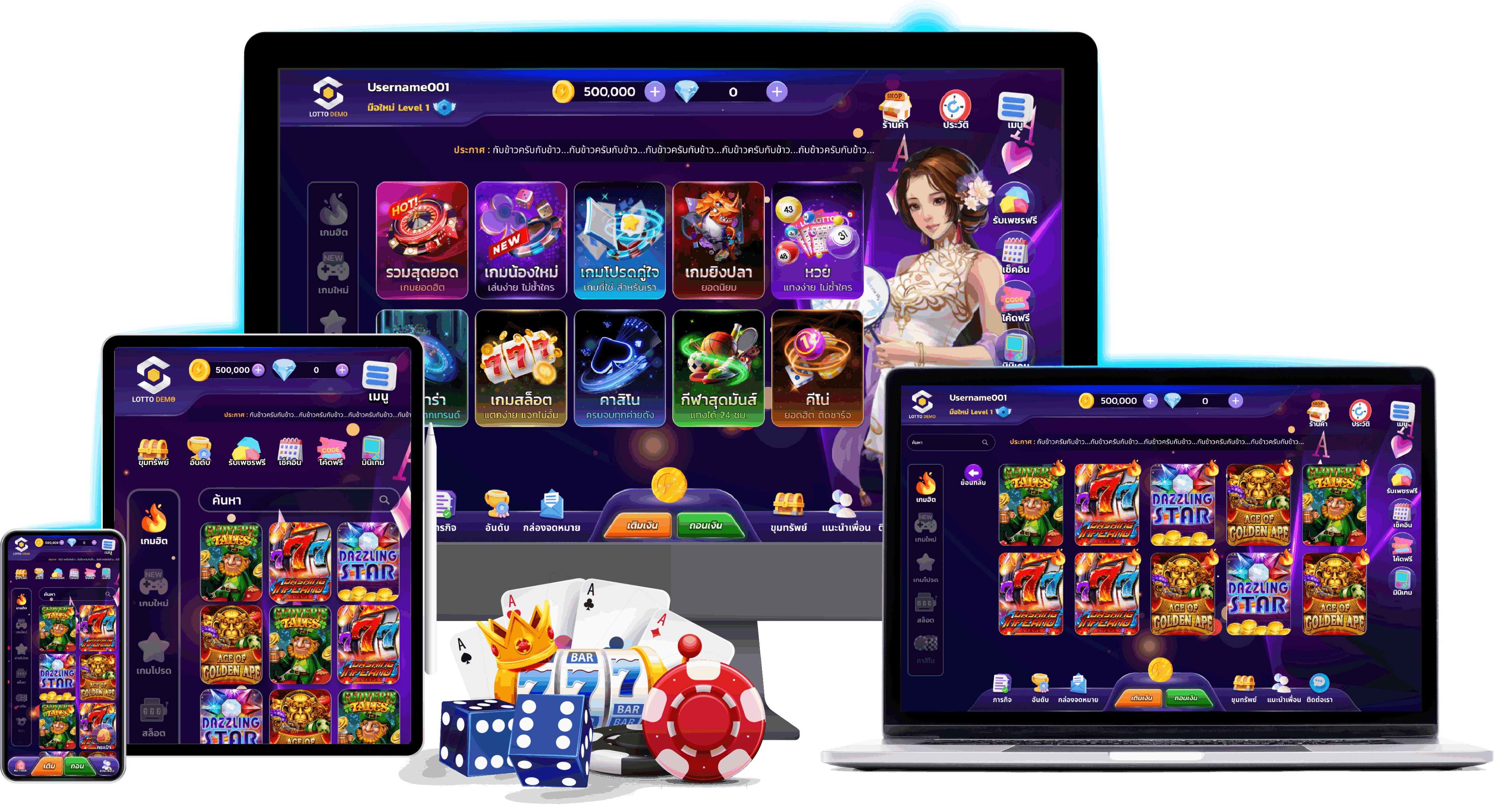

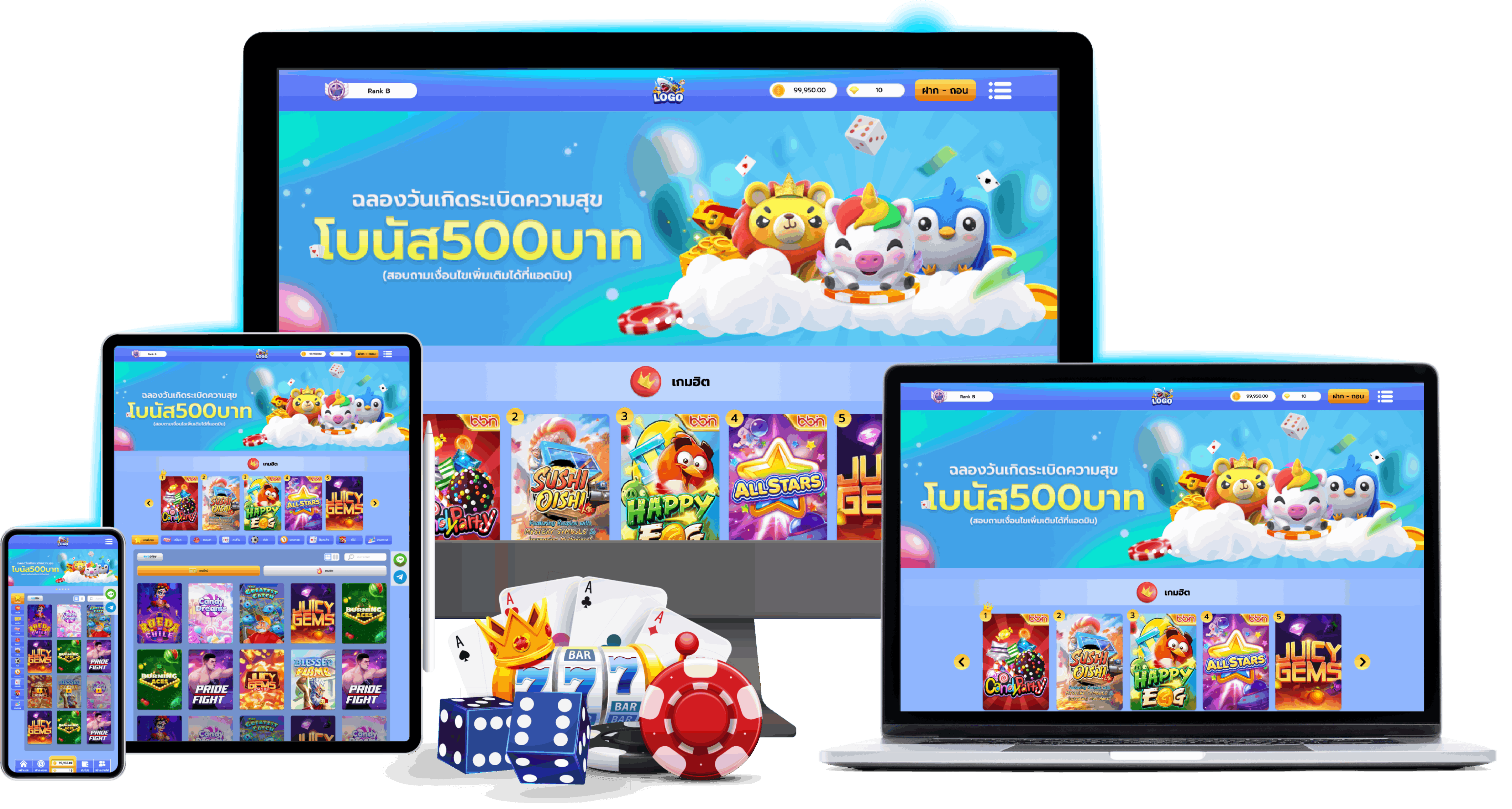

เล่นสล็อตเข้าถึงง่ายผ่านมือถือ รองรับวัสดุอุปกรณ์การพนันทุกรุ่น

Pussy888 พุซซี่888 พุซซี่888 ได้รับการปรับให้เหมาะสมกับการเล่นเกมบนโทรศัพท์มือถือ ช่วยทำให้ผู้เล่นเพลิดเพลินใจไปกับเกมสล็อต ที่ชื่นชอบบนสมาร์ทโฟนรวมทั้งแท็บเล็ต ความสะดวกสบายนี้ทำให้เป็นตัวเลือกอันดับต้นๆสำหรับผู้เล่นที่ชื่นชอบเกี่ยวกับการเล่นเกมระหว่างเดินทาง เพิ่มประสบการณ์ใหม่ให้กับผู้ใช้แพลตฟอร์ม โดยผู้พัฒนาระบบของพวกเรานี้ให้ความใส่ใจกับประสบการณ์ผู้ใช้ที่ราบสดชื่นและเบิกบาน รูแบบที่ใช้งานง่ายและก็เพิ่มความสบายสบายสำหรับการใช้งาน ทำให้อีกทั้งผู้เล่นมือใหม่รวมทั้งผู้เล่นที่มีประสบการณ์ สามารถเข้าถึงได้ การเข้าถึงเกมพนันได้ง่าย และคิดถึงสิ่งที่ดีต่อผู้ใช้นี้มีส่วนทำให้ได้รับความนิยม

โบนัสรวมทั้งโปรโมชั่นคุ้ม พร้อมมอบให้ลูกค้า พุซซี่888 พุซซี่888

เช่นเดียวกับคาสิโนออนไลน์หลายที่ ที่มีการเสนอโบนัสและโปรโมชั่นมากไม่น้อยเลยทีเดียวเพื่อล่อใจรักษาผู้เล่น สิ่งเหล่านี้อาจรวมทั้งโบนัสต้อนรับ ฟรีสปิน แล้วก็รางวัลตอบแทนผู้ใช้งาน ทำให้ผู้เล่นได้โอกาสพิเศษที่จะชนะโดยทั่วไปแล้ว พุซซี่888 pussy888 จะให้การสนับสนุนลูกค้าเพื่อช่วยเหลือผู้เล่นสำหรับเพื่อการถามหรือปัญหาอะไรก็ตามที่พวกเขาบางทีอาจเจอขณะเล่นสล็อตหรือใช้แพลตฟอร์ม สิ่งสำคัญเป็นจำต้องรู้ว่าความพร้อมใช้งานรวมทั้งคุณลักษณะของเราอาจเปลี่ยนแปลงไปตามกาลเวลา โดยเหตุนั้นก็เลยแนะนำให้เยี่ยมชมเว็บอย่างเป็นทางการหรือติดต่อฝ่ายสนับสนุนลูกค้า เพื่อรับข้อมูลปัจจุบันเกี่ยวกับเกมสล็อตและก็บริการของพวกเรา นอกจากนั้นเรายังพร้อมให้บริการการเดิมพันด้วยคุณภาพ

ความปลอดภัยแล้วก็การเล่นมีความเที่ยงธรรม

คาสิโนออนไลน์ที่มีชื่อให้ความสำคัญกับความปลอดภัยและการเล่นที่เที่ยงธรรม พวกเราใช้เทคโนโลยีการเข้ารหัสเพื่อปกป้องรักษาข้อมูลของผู้เล่น รวมทั้งยืนยันว่าเกมสล็อตมีความถูกต้อง โดยไม่มีเรื่องราวทุจริตซึ่งสามารถตรวจสอบจากการรีวิว และก็บอกต่อบคอยการจากผู้ใช้งานจริงได้เลย ทั้งยังตัวเลือกการชำระเงินโดยธรรมดาพวกเรามีวิธีการจ่ายเงินที่มากมาย สำหรับในการฝากรวมทั้งถอนเงิน รวมถึงบัตรเครดิต กระเป๋าเงินอิเล็กทรอนิกส์ และการโอนเงินผ่านธนาคาร ความยืดหยุ่นนี้ทำให้ผู้เล่นสามารถจัดแจงเงินลงทุนของตนได้สบาย

เพราะเหตุไรเกมสล็อต พุซซี่888 ทั้งในระบบทั่วๆไปและก็ออนไลน์ถึงเป็นที่นิยมอย่างยิ่ง

แน่ๆ! ในบริบทของการเล่นเกม โดยทั่วไป สล็อต จะซึ่งก็คือเกมคาสิโนชนิดหนึ่งที่เรียกว่า

สล็อตออนไลน์ นี่คือเรื่องสำคัญบางประการเกี่ยวกับสล็อตเกมจากค่าย pussy888fun

พื้นฐานของสล็อตออนไลน์ สล็อตออนไลน์เป็นเกมการเดิมพันที่ได้รับความนิยมที่เจอได้อีกทั้งในคาสิโนทั่วไปรวมทั้งคาสิโนออนไลน์จะมีวงล้อ (ธรรมดาสามวงขึ้นไป) ที่หมุนเมื่อผู้เล่นเปิดใช้งาน

• สัญลักษณ์สล็อตออนไลน์ พุซซี่888 มีสัญลักษณ์ต่างๆบนวงล้อ อย่างเช่น ผลไม้ จำนวน ตัวอักษร และก็ไอคอนตามธีม ชุดค่าผสมที่ชนะจะเกิดขึ้นเมื่อเครื่องหมายเฉพาะเรียงกันในลักษณะใดลักษณะหนึ่ง

• ช่องชำระเงิน ช่องชำระเงินเป็นเส้นที่พาดผ่านวงล้อที่สามารถเกิดชุดค่าผสมที่ชนะได้ สล็อตออนไลน์แต่ละเครื่องมีปริมาณช่องจ่ายเงินที่ไม่เหมือนกัน ตั้งแต่บรรทัดเดียวไปจนถึงหลักร้อยหรือหลักพัน

• การเดิมพันและการชำระเงินผู้เล่นวางเดิมพันก่อนหมุนวงล้อ แล้วก็จำนวนเงินที่ชนะจะขึ้นอยู่กับการรวมกันของสัญลักษณ์เฉพาะที่ปรากฏบนเพย์ไลน์ การชำระเงินบางทีอาจไม่เหมือนกันอย่างยิ่ง โดยบางสล็อตเสนอแจ็คพอตแบบโปรเกรสซีฟที่อาจจะเป็นผลให้กำเนิดความมีชัยครั้งใหญ่

• ธีมแล้วก็ฟีพบร์ สล็อตออนไลน์มีธีมหลากหลาย ดังเช่นว่า อียิปต์โบราณ ตำนาน ภาพยนตร์ แล้วก็ฯลฯ สล็อตจำนวนหลายชิ้นยังมีฟีเจอร์โบนัส ได้แก่ ฟรีสปิน สัญลักษณ์เสริม รวมทั้งไม่นิเกมเพื่อทำให้การเล่นเกมน่าตื่นเต้นเพิ่มขึ้น

• ตัวก่อร่างสร้างตัวเลขสุ่ม (RNG) สล็อตออนไลน์ยุคใหม่ใช้เทคโนโลยี RNG เพื่อมั่นใจว่าคำตอบของการหมุนแต่ละครั้งจะเป็นแบบสุ่มรวมทั้งเป็นธรรมทั้งสิ้น ซึ่งแสดงว่าการชนะคือเรื่องของโชคเป็นส่วนใหญ่

สล็อตออนไลน์ pussy888 ปากทางเข้าเล่นเสถียรภาพ ระบบมั่นคง

เกมสล็อตจึงเข้าถึงได้ง่ายยิ่งขึ้น ผู้เล่นสามารถเพลิดเพลินเจริญใจกับสล็อตที่หลากหลายได้จากที่บ้านหรือบนอุปกรณ์โทรศัพท์เคลื่อนที่ พนันอย่างมีสติสัมปชัญญะ สล็อตออนไลน์ พุซซี่888 เป็นความรื่นเริง แม้กระนั้นก็สามารถเสพติดได้เช่นเดียวกัน เป็นสิ่งจำเป็นสำหรับผู้เล่นในการเดิมพันอย่างมีความรับผิดชอบรวมทั้งระบุวงเงินการใช้จ่ายของพวกเขา สล็อตออนไลน์เป็นเลิศในเกมคาสิโนที่ได้รับความนิยมเยอะที่สุดเพราะว่าความเรียบง่ายและมีโอกาสจ่ายเงินรางวัลเป็นจำนวนมาก ผู้เล่นหลากหลายประเภทถูกใจตั้งแต่นักเดิมพันทั่วไปไปจนกระทั่งนักพนันขั้นสูง โปรดจำไว้ว่าในเวลาที่การเล่นสล็อตสามารถสนุกสนานรวมทั้งสร้างกำไรได้ แต่ว่าก็มีการเสี่ยงสำหรับเพื่อการสูญเสียเงินด้วยเหมือนกัน สิ่งจำเป็นเป็นต้องเล่นการพนันอย่างมีมีสติและอยู่ในทางระบุของคุณ

การลงพนันเกมสล็อตออนไลน์ สล็อต บนเว็บนี้ เป็นอีกหนึ่งหนทางวิธีการทำเงินสร้างรายได้ที่รื้นเริง และก็พร้อมแจกโบนัสรางวัล ยินดีต้อนรับนักพนันที่มีทุนน้อย ให้ได้สัมผัสกับเว็บตรงไม่ผ่านเอเย่นต์ ที่สามารถเข้าถึงได้ผ่านทางหน้าเว็บไซต์ หรือจะติดตั้งแอปพลิเคชันลงบนมือถือก็สามารถทำเป็น

สล็อตพุซซี่888 pussy888 บริการ 24 ชั่วโมง 1 ตุลาคม 2023 Arthur โอนเงินสด สล็อตทดลองเล่นฟรี Top 79

สล็อตพุซซี่888 pussy888 บริการ 24 ชั่วโมง 1 ตุลาคม 2023 Arthur โอนเงินสด สล็อตทดลองเล่นฟรี Top 79

ขอขอบคุณมากเว็ปไซต์ พุซซี่888

สล็อตเว็บตรงเว็บไหนดี punpro PunPro777.com 11 สิงหา 22 สล็อตเว็บตรง แตกง่าย เนื่องจากว่าคนนิยมเล่นสล็อตเว็บตรง777 สล็อตออนไลน์ เครดิตฟรี

สล็อตเว็บตรงเว็บไหนดี punpro PunPro777.com 11 สิงหา 22 สล็อตเว็บตรง แตกง่าย เนื่องจากว่าคนนิยมเล่นสล็อตเว็บตรง777 สล็อตออนไลน์ เครดิตฟรี เว็บตรงไม่ผ่านเอเย่นต์ ที่มีผู้เล่นเข้าใช้บริการไม่น้อยเลยทีเดียว รวมทุกค่ายเกมเปิดใหม่ ให้บริการเกมมากไม่น้อยเลยทีเดียวว่า มีแต่ว่าเกมที่แตกหลายครั้ง รางวัลใหญ่แตกประจำ ถอนได้ไม่ยั้ง เล่น punpro สล็อต ได้วันละเป็นล้านก็สามารถถอนออกได้ ลุ้นรับสินทรัพย์ได้วันแล้ววันเล่า ถ้าหากได้ตกลงใจเข้ามาร่วมบันเทิงใจกับ สล็อตแตกง่าย จังหวะที่จะเป็นคนมั่งคั่งก็อยู่ไม่ไกล เป็นเว็บที่มาแรงกว่าคนไหนกัน ให้บริการตามมาตรฐานสากล แถมยังเปิดรองรับผู้เล่นทั่วโลก ถ้าเกิดคนไหนที่อยากได้เล่นเกมสล็อตที่ตอบปัญหา บอกเลยว่าต้องมาเล่นตรงนี้แค่นั้น จบในที่เดียว ค้ำประกันว่าจะประทับใจจนตราบเท่าไม่คิดที่จะเปลี่ยนเว็บไซต์อีกเลย

เว็บตรงไม่ผ่านเอเย่นต์ ที่มีผู้เล่นเข้าใช้บริการไม่น้อยเลยทีเดียว รวมทุกค่ายเกมเปิดใหม่ ให้บริการเกมมากไม่น้อยเลยทีเดียวว่า มีแต่ว่าเกมที่แตกหลายครั้ง รางวัลใหญ่แตกประจำ ถอนได้ไม่ยั้ง เล่น punpro สล็อต ได้วันละเป็นล้านก็สามารถถอนออกได้ ลุ้นรับสินทรัพย์ได้วันแล้ววันเล่า ถ้าหากได้ตกลงใจเข้ามาร่วมบันเทิงใจกับ สล็อตแตกง่าย จังหวะที่จะเป็นคนมั่งคั่งก็อยู่ไม่ไกล เป็นเว็บที่มาแรงกว่าคนไหนกัน ให้บริการตามมาตรฐานสากล แถมยังเปิดรองรับผู้เล่นทั่วโลก ถ้าเกิดคนไหนที่อยากได้เล่นเกมสล็อตที่ตอบปัญหา บอกเลยว่าต้องมาเล่นตรงนี้แค่นั้น จบในที่เดียว ค้ำประกันว่าจะประทับใจจนตราบเท่าไม่คิดที่จะเปลี่ยนเว็บไซต์อีกเลย ไม่มีเบื่อ สล็อตแตกง่าย แจกเครดิตฟรี ก็ยังเต็มไปด้วยเกมสล็อตแนวใหม่ๆให้เล่นแบบไม่ซ้ำซาก เลือกเล่นได้ไม่ยั้ง คัดสรรแม้ว่าสิ่งดีๆมาเสิร์ฟถึงจอมือถือผู้เล่นทุกคน บอกเลยว่าที่นี่ สล็อตแตกง่ายที่สุด ไม่ต้องโหลดแอพให้ขวางสมาร์ทโฟน ก็สามารถเข้าเล่นผ่านหน้าเว็บของเราได้ทันทีทันใด เว็บ

ไม่มีเบื่อ สล็อตแตกง่าย แจกเครดิตฟรี ก็ยังเต็มไปด้วยเกมสล็อตแนวใหม่ๆให้เล่นแบบไม่ซ้ำซาก เลือกเล่นได้ไม่ยั้ง คัดสรรแม้ว่าสิ่งดีๆมาเสิร์ฟถึงจอมือถือผู้เล่นทุกคน บอกเลยว่าที่นี่ สล็อตแตกง่ายที่สุด ไม่ต้องโหลดแอพให้ขวางสมาร์ทโฟน ก็สามารถเข้าเล่นผ่านหน้าเว็บของเราได้ทันทีทันใด เว็บ  เราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ ได้รับการรับรองจากบริษัทแม่อย่าง PG ที่เป็นบริษัทชั้นหนึ่งสุดยอด คุณจะได้รับความปลอดภัยสำหรับการเล่นสล็อตออนไลน์กับพวกเราอย่างแน่แท้ ด้วยระบบหน้าเว็บไซต์ที่ดียอด ใช้งานได้ดีแบบไม่มีสะดุด ระบบฝากถอนออโต้ที่ทำรายการได้ง่ายๆด้วยตัวเอง ไม่มีอันตรายและก็เร็วทันใจแบบสุดๆเกมสล็อตออนไลน์จากค่าย

เราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ ได้รับการรับรองจากบริษัทแม่อย่าง PG ที่เป็นบริษัทชั้นหนึ่งสุดยอด คุณจะได้รับความปลอดภัยสำหรับการเล่นสล็อตออนไลน์กับพวกเราอย่างแน่แท้ ด้วยระบบหน้าเว็บไซต์ที่ดียอด ใช้งานได้ดีแบบไม่มีสะดุด ระบบฝากถอนออโต้ที่ทำรายการได้ง่ายๆด้วยตัวเอง ไม่มีอันตรายและก็เร็วทันใจแบบสุดๆเกมสล็อตออนไลน์จากค่าย  1. โปรโมชั่นสมาชิกใหม่ 250%

1. โปรโมชั่นสมาชิกใหม่ 250%

7. Jubyet69 ได้จัดหนังเอ็กซ์ซับไทย กับเหล่าผู้ช่วยจำนวนมาก ทำให้เรา Jubyet69 มี หนัง69 ซับไทย หนังเอวี69 ซับไทย ดูหนังx

7. Jubyet69 ได้จัดหนังเอ็กซ์ซับไทย กับเหล่าผู้ช่วยจำนวนมาก ทำให้เรา Jubyet69 มี หนัง69 ซับไทย หนังเอวี69 ซับไทย ดูหนังx

แนวทางเล่นสล็อตครั้งแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บไซต์มาแรง ที่และคุณภาพpg จะพาคุณไปตรวจสอบวิธีการเล่นฉบับมือใหม่ เป็นแนวทางการเล่นที่เข้าใจง่าย ทำเงินได้จริง คุณจะสนุกสนานกับการเดิมพันได้ไม่ติด ไม่ว่าจะเล่นผ่านอุปกรณ์ไหน พวกเราพร้อมจ่ายรางวัลเต็มไม่หัก ไม่มีการล็อคผลชนะ PGSLOT เว็บไซต์พนันครบวงจร พร้อมเปิดให้เข้ามาสนุกสนานกับการพนันผ่านมือถือ สัมผัสความครบครันของบริการ ที่จะเปลี่ยนให้คุณเป็นลูกค้า VIP เข้าถึงเกมสล็อตสุดพรีเมี่ยวได้ทุกวัน

แนวทางเล่นสล็อตครั้งแรก เล่นแบบไหนให้โบนัสแตก แบบไม่ต้องขอคืนดีดวง วันนี้ เว็บไซต์มาแรง ที่และคุณภาพpg จะพาคุณไปตรวจสอบวิธีการเล่นฉบับมือใหม่ เป็นแนวทางการเล่นที่เข้าใจง่าย ทำเงินได้จริง คุณจะสนุกสนานกับการเดิมพันได้ไม่ติด ไม่ว่าจะเล่นผ่านอุปกรณ์ไหน พวกเราพร้อมจ่ายรางวัลเต็มไม่หัก ไม่มีการล็อคผลชนะ PGSLOT เว็บไซต์พนันครบวงจร พร้อมเปิดให้เข้ามาสนุกสนานกับการพนันผ่านมือถือ สัมผัสความครบครันของบริการ ที่จะเปลี่ยนให้คุณเป็นลูกค้า VIP เข้าถึงเกมสล็อตสุดพรีเมี่ยวได้ทุกวัน แจก วิธีเล่นสล็อต pg ให้ แตก สล็อต ฉบับคนเล่นจริง 2022

แจก วิธีเล่นสล็อต pg ให้ แตก สล็อต ฉบับคนเล่นจริง 2022 ฝึกเล่นสล็อตฟรี เริ่มด้วยเลือก เว็บไซต์ เล่น สล็อต

ฝึกเล่นสล็อตฟรี เริ่มด้วยเลือก เว็บไซต์ เล่น สล็อต สล็อต888สล็อต888 เป็นเว็บไซต์สล็อตออนไลน์ชื่อดัง

สล็อต888สล็อต888 เป็นเว็บไซต์สล็อตออนไลน์ชื่อดัง  บริการสล็อตออนไลน์ครบวงจร ทีมงานคอยดูแลซัพพอร์ตอย่างดี

บริการสล็อตออนไลน์ครบวงจร ทีมงานคอยดูแลซัพพอร์ตอย่างดี เดิมพันสล็อตออนไลน์ฝากถอนไม่มีขั้นต่ำ เริ่มต้น 1 บาทก็รวยได้

เดิมพันสล็อตออนไลน์ฝากถอนไม่มีขั้นต่ำ เริ่มต้น 1 บาทก็รวยได้ ตรงนี้ จึงออกจะให้ความใส่ใจเป็นอย่างมาก ในเรื่องเกี่ยวกับการใช้ภาษาหรือรวมถึง การจัดการในระดับนานาชาติ ที่ซึ่งพูดได้ว่ามีการขนเอาหลักสูตรต่างๆในระดับสากลมาเอาไว้ภายในที่นี้ที่เดียว อย่างชัดเจนและก็เป็นอะไรที่ค่อนข้างจะล้ำหน้าไปมากเลย สำหรับการเรียนรู้จาก ราชภัฏ ที่เปิดสอนถึง 4 วิชาสาขาเลยทีเดียวตัวอย่างเช่น

ตรงนี้ จึงออกจะให้ความใส่ใจเป็นอย่างมาก ในเรื่องเกี่ยวกับการใช้ภาษาหรือรวมถึง การจัดการในระดับนานาชาติ ที่ซึ่งพูดได้ว่ามีการขนเอาหลักสูตรต่างๆในระดับสากลมาเอาไว้ภายในที่นี้ที่เดียว อย่างชัดเจนและก็เป็นอะไรที่ค่อนข้างจะล้ำหน้าไปมากเลย สำหรับการเรียนรู้จาก ราชภัฏ ที่เปิดสอนถึง 4 วิชาสาขาเลยทีเดียวตัวอย่างเช่น สำหรับสมัครเข้าเรียน

สำหรับสมัครเข้าเรียน

.png)

joker123.money สล็อตเว็บตรงสมาชิกใหม่มาแรง สล็อตเว็บตรงแท้ 100% ทดลองเลย!

joker123.money สล็อตเว็บตรงสมาชิกใหม่มาแรง สล็อตเว็บตรงแท้ 100% ทดลองเลย! คนไม่ใช่น้อยบางทีอาจจะเคยทราบหรือมองเห็นคำว่า GGEZ กันมาบ้างแล้ว ซึ่งมันก็คือ Good Game Easy นั่นแหละนะครับ ในศัพท์เกมมันก็จะซึ่งก็คือ เกมนี้เป็นเกมที่ดีนะ แต่ง่ายมากๆเลย ซึ่งเป็นความหมายในแง่ลบซะมากยิ่งกว่า แต่ขอรับแต่ ที่ผมยกมาใช้กับการสมัครเป็นสมาชิกของโจ๊กเกอร์123 เนื่องจากว่ามันง่ายเลเวลนั้นเลยล่ะครับผม สมัครง่ายแบบสุดๆใช้ข้อมูลแค่เบอร์โทรศัพท์มือถือแล้วก็เลขบัญชีธนาคารเพียงแค่นั้น คุณก็สามารถสมัคร โจ๊กเกอร์123 ได้แล้วนะครับ ซึ่งขั้นตอนในการสมัครเป็นสมาชิกกับ joker123 ก็ง่ายๆเลยขอรับ สามารถสมัครได้เลย เพียงแค่กดปุ่มสมัครเป็นสมาชิก กรอกเบอร์โทรศัพท์มือถือลงไป ระบบจะส่งรหัส OTP เพื่อยืนยันตัวตนกับคุณอีกที ตั้งรหัสผ่านที่อยากได้ใช้สำหรับ Login เลือกธนาคารและกรอกเลขลำดับบัญชีธนาคาร เลือกหนทางที่ทำให้ท่านรู้จักเรา joker123.money กดลงทะเบียนสมัครสมาชิก เป็นอันเสร็จเรียบร้อยสิ้นทุกขั้นตอนเลยนะครับ บอกเลยครับว่า ง่ายแสนง่ายจริงๆขอรับ ไม่ว่าใครก็สามารถลงทะเบียนเป็นสมาชิกกับเราได้ไม่ยากเลย GGEZ จริงๆครับผม!

คนไม่ใช่น้อยบางทีอาจจะเคยทราบหรือมองเห็นคำว่า GGEZ กันมาบ้างแล้ว ซึ่งมันก็คือ Good Game Easy นั่นแหละนะครับ ในศัพท์เกมมันก็จะซึ่งก็คือ เกมนี้เป็นเกมที่ดีนะ แต่ง่ายมากๆเลย ซึ่งเป็นความหมายในแง่ลบซะมากยิ่งกว่า แต่ขอรับแต่ ที่ผมยกมาใช้กับการสมัครเป็นสมาชิกของโจ๊กเกอร์123 เนื่องจากว่ามันง่ายเลเวลนั้นเลยล่ะครับผม สมัครง่ายแบบสุดๆใช้ข้อมูลแค่เบอร์โทรศัพท์มือถือแล้วก็เลขบัญชีธนาคารเพียงแค่นั้น คุณก็สามารถสมัคร โจ๊กเกอร์123 ได้แล้วนะครับ ซึ่งขั้นตอนในการสมัครเป็นสมาชิกกับ joker123 ก็ง่ายๆเลยขอรับ สามารถสมัครได้เลย เพียงแค่กดปุ่มสมัครเป็นสมาชิก กรอกเบอร์โทรศัพท์มือถือลงไป ระบบจะส่งรหัส OTP เพื่อยืนยันตัวตนกับคุณอีกที ตั้งรหัสผ่านที่อยากได้ใช้สำหรับ Login เลือกธนาคารและกรอกเลขลำดับบัญชีธนาคาร เลือกหนทางที่ทำให้ท่านรู้จักเรา joker123.money กดลงทะเบียนสมัครสมาชิก เป็นอันเสร็จเรียบร้อยสิ้นทุกขั้นตอนเลยนะครับ บอกเลยครับว่า ง่ายแสนง่ายจริงๆขอรับ ไม่ว่าใครก็สามารถลงทะเบียนเป็นสมาชิกกับเราได้ไม่ยากเลย GGEZ จริงๆครับผม!

.png) สำหรับในการเรียน สวนสุนันทา สาขา โลจิสติกส์และก็ซัพพลายเชน สาขาวิชาการจัดการโลจิสติกส์ รวมทั้งซัพพลายเชนเชิงที่มีความสำคัญในการรบสากล ก็นับได้ว่าเป็นอีกหนึ่งคณะที่ได้รับการจัดตามมองดู อยู่พอควร แล้วก็เป็นอีกหนึ่งจุด

สำหรับในการเรียน สวนสุนันทา สาขา โลจิสติกส์และก็ซัพพลายเชน สาขาวิชาการจัดการโลจิสติกส์ รวมทั้งซัพพลายเชนเชิงที่มีความสำคัญในการรบสากล ก็นับได้ว่าเป็นอีกหนึ่งคณะที่ได้รับการจัดตามมองดู อยู่พอควร แล้วก็เป็นอีกหนึ่งจุด  ก็เลยเชื่อได้ว่า ที่จะเป็นอะไรที่ค่อนข้างจะมีความยอดเยี่ยม เป็นความสำคัญรวมทั้งเป็นจุดเด่นที่ดีไม่น้อย อย่างยิ่งจริงๆ กับการเลือกวิชาสาขานี้ ในด้านการศึกษาเล่าเรียนของมหาวิทยาลัยราชภัฏ ที่สามารถช่วยให้เพิ่มความถนัดแล้วก็สามารถที่จะจบมามีงาน ทำในธุรกิจการบินได้อย่างแน่แท้

ก็เลยเชื่อได้ว่า ที่จะเป็นอะไรที่ค่อนข้างจะมีความยอดเยี่ยม เป็นความสำคัญรวมทั้งเป็นจุดเด่นที่ดีไม่น้อย อย่างยิ่งจริงๆ กับการเลือกวิชาสาขานี้ ในด้านการศึกษาเล่าเรียนของมหาวิทยาลัยราชภัฏ ที่สามารถช่วยให้เพิ่มความถนัดแล้วก็สามารถที่จะจบมามีงาน ทำในธุรกิจการบินได้อย่างแน่แท้ Joker123 ทางเข้าเล่น สล็อตออนไลน์ แจกเครดิตฟรีทุกวี่วัน

Joker123 ทางเข้าเล่น สล็อตออนไลน์ แจกเครดิตฟรีทุกวี่วัน อยากสนุกสนานกับการเล่นสล็อตออนไลน์และมีโอกาสได้รับเครดิตฟรีทุกเมื่อเชื่อวันกันรึป่าวประกาศ มาพบกับ Joker123 ที่มีทางเข้าเล่นสล็อตออนไลน์และแจกเครดิตฟรีทุกวี่ทุกวันเพื่อให้คุณสนุกไปกับเกมในวันพิเศษของคุณ การเข้าสู่โลกของการเล่นสล็อตออนไลน์ใน

อยากสนุกสนานกับการเล่นสล็อตออนไลน์และมีโอกาสได้รับเครดิตฟรีทุกเมื่อเชื่อวันกันรึป่าวประกาศ มาพบกับ Joker123 ที่มีทางเข้าเล่นสล็อตออนไลน์และแจกเครดิตฟรีทุกวี่ทุกวันเพื่อให้คุณสนุกไปกับเกมในวันพิเศษของคุณ การเข้าสู่โลกของการเล่นสล็อตออนไลน์ใน  ให้บริการ 1 วัน สล็อต โจ๊กเกอร์123 ออโต้ หมุนเข้าโบนัสทุกรอบ ได้กำไรหลักแสน

ให้บริการ 1 วัน สล็อต โจ๊กเกอร์123 ออโต้ หมุนเข้าโบนัสทุกรอบ ได้กำไรหลักแสน

เว็บตรง คนรวย99 ทดลองเล่นสล็อตฟรี ได้เงินจริง ถอนได้ไม่อั้น ทุกเกม

เว็บตรง คนรวย99 ทดลองเล่นสล็อตฟรี ได้เงินจริง ถอนได้ไม่อั้น ทุกเกม ปากทางเข้าเล่นสล็อต ผ่านมือถือ ที่ปลอดภัยที่สุด

ปากทางเข้าเล่นสล็อต ผ่านมือถือ ที่ปลอดภัยที่สุด สำหรับทางเข้าเล่นสล็อตผ่านมือถือในเว็บสล็อตเว็บตรงของเรา เป็นทางเข้าที่มีความนำสมัยมากๆผู้เล่นสามารถเข้าเล่นสล็อตออนไลน์ผ่านระบบโทรศัพท์เคลื่อนที่ได้ง่ายๆและทดลองเล่นเกมสล็อตได้ในทันที มาพร้อมความปลอดภัยเป็นเรื่องสำคัญที่ไม่สมควรปล่อยทิ้ง ด้วยเหตุว่าผู้เล่นจำเป็นต้องแน่ใจว่าข้อมูลและเงินที่พนันจะถูกคุ้มครองป้องกันอย่างดี เพื่อได้รับประสบการณ์การเล่นที่ปลอดภัยและเพลิดเพลินใจ ปากทางเข้าทดสอบเล่นสล็อตโทรศัพท์เคลื่อนที่ที่ปลอดภัยที่สุด เพื่อช่วยให้ผู้เล่นมีความรู้และมีความเข้าใจและเลือกเล่นอย่างมั่นใจ

สำหรับทางเข้าเล่นสล็อตผ่านมือถือในเว็บสล็อตเว็บตรงของเรา เป็นทางเข้าที่มีความนำสมัยมากๆผู้เล่นสามารถเข้าเล่นสล็อตออนไลน์ผ่านระบบโทรศัพท์เคลื่อนที่ได้ง่ายๆและทดลองเล่นเกมสล็อตได้ในทันที มาพร้อมความปลอดภัยเป็นเรื่องสำคัญที่ไม่สมควรปล่อยทิ้ง ด้วยเหตุว่าผู้เล่นจำเป็นต้องแน่ใจว่าข้อมูลและเงินที่พนันจะถูกคุ้มครองป้องกันอย่างดี เพื่อได้รับประสบการณ์การเล่นที่ปลอดภัยและเพลิดเพลินใจ ปากทางเข้าทดสอบเล่นสล็อตโทรศัพท์เคลื่อนที่ที่ปลอดภัยที่สุด เพื่อช่วยให้ผู้เล่นมีความรู้และมีความเข้าใจและเลือกเล่นอย่างมั่นใจ การเล่นslotมือถือทดลองเล่นเป็นการพบประสบการณ์ที่น่าสนุกและตื่นเต้น แม้กระนั้นความปลอดภัยสำหรับการเล่นเป็นเรื่องสำคัญที่ผู้เล่นควรจะให้ความใส่ใจ เพื่อป้องกันการสูญเสียข้อมูลส่วนตัวแล้วก็การทำรายการเงินที่ไม่ปรารถนา การเลือกทางเข้าทดลองเล่นสล็อตเว็บตรงโทรศัพท์มือถือที่มีมาตรฐานแล้วก็มีระบบระเบียบความปลอดภัยที่ดีเป็นเรื่องจำเป็น ผู้เล่นควรจะใช้เวลาสำหรับการพินิจพิจารณารวมทั้งเลือกเว็บไซต์หรือแอปพลิเคชันที่มีความเชื่อถือและมีความปลอดภัยที่สุด เพื่อประสบการณ์การเดิมพันที่รื้นเริงรวมทั้งไม่เป็นอันตรายอย่างแท้จริง

การเล่นslotมือถือทดลองเล่นเป็นการพบประสบการณ์ที่น่าสนุกและตื่นเต้น แม้กระนั้นความปลอดภัยสำหรับการเล่นเป็นเรื่องสำคัญที่ผู้เล่นควรจะให้ความใส่ใจ เพื่อป้องกันการสูญเสียข้อมูลส่วนตัวแล้วก็การทำรายการเงินที่ไม่ปรารถนา การเลือกทางเข้าทดลองเล่นสล็อตเว็บตรงโทรศัพท์มือถือที่มีมาตรฐานแล้วก็มีระบบระเบียบความปลอดภัยที่ดีเป็นเรื่องจำเป็น ผู้เล่นควรจะใช้เวลาสำหรับการพินิจพิจารณารวมทั้งเลือกเว็บไซต์หรือแอปพลิเคชันที่มีความเชื่อถือและมีความปลอดภัยที่สุด เพื่อประสบการณ์การเดิมพันที่รื้นเริงรวมทั้งไม่เป็นอันตรายอย่างแท้จริง ยุคนี้การเล่น สล็อต เริ่มเป็นที่นิยมมากๆเพราะสามารถทำรายได้ให้กับผู้เล่นได้ง่ายดายๆหลายท่านคงจะเคยเล่นเกมสล็อตมาแล้ว แต่ว่ายังไม่เคยบรรลุความสำเร็จ เพราะเหตุว่ายังไม่รู้เรื่องเทคนิกสำหรับเพื่อการเล่นเกมสล็อตกันแน่นอนในเกม สล็อต นี้ไม่เฉพาะแต่มีกระแสความนิยมสูง แต่ยังมีโอกาสสำหรับในการชนะเงินรางวัลใหญ่โดยไม่ต้องลงทุนมาก เพียงมีเคล็ดลับที่สมควรรวมทั้งเคล็ดวิธีที่ดี การเล่นสล็อตก็บางครั้งอาจจะกลายเป็นโอกาสที่ดี รวมทั้งน่าดึงดูดสำหรับในการเล่นและก็การหารายได้เข้ากระเป๋าสำหรับคุณแน่ๆ

ยุคนี้การเล่น สล็อต เริ่มเป็นที่นิยมมากๆเพราะสามารถทำรายได้ให้กับผู้เล่นได้ง่ายดายๆหลายท่านคงจะเคยเล่นเกมสล็อตมาแล้ว แต่ว่ายังไม่เคยบรรลุความสำเร็จ เพราะเหตุว่ายังไม่รู้เรื่องเทคนิกสำหรับเพื่อการเล่นเกมสล็อตกันแน่นอนในเกม สล็อต นี้ไม่เฉพาะแต่มีกระแสความนิยมสูง แต่ยังมีโอกาสสำหรับในการชนะเงินรางวัลใหญ่โดยไม่ต้องลงทุนมาก เพียงมีเคล็ดลับที่สมควรรวมทั้งเคล็ดวิธีที่ดี การเล่นสล็อตก็บางครั้งอาจจะกลายเป็นโอกาสที่ดี รวมทั้งน่าดึงดูดสำหรับในการเล่นและก็การหารายได้เข้ากระเป๋าสำหรับคุณแน่ๆ

จะมองหาสล็อตเว็บไซต์ตรงแท้อยู่เพราะเหตุไร? ในเมื่อเว็บไซต์ตรงแท้ไม่ผ่านเอเย่นต์อยู่เบื้องหน้าคุณแล้ว เรา

จะมองหาสล็อตเว็บไซต์ตรงแท้อยู่เพราะเหตุไร? ในเมื่อเว็บไซต์ตรงแท้ไม่ผ่านเอเย่นต์อยู่เบื้องหน้าคุณแล้ว เรา  เป็นอย่างไรกันบ้างนะครับ ผมมั่นใจว่า หลังจากที่คุณได้อ่านเหตุผลต่างๆรวมถึงได้ทราบจะกับโปรโมชั่นดีๆจากพวกเราอย่างโปรโมชั่นฝากแรกของวัน คุณก็น่าจะพึงพอใจแล้วก็อยากทดลองสมัครสมาชิกใหม่กับเรา pgslot กันแล้วใช่ไหมล่ะครับ? หากคุณพอใจสมัครเป็นสมาชิกใหม่ล่ะก็ คุณสามารถเข้าไปสมัครเป็นสมาชิกที่หน้าเว็บไซต์pgslotของเราได้เลยนะขอรับ เพียงจัดเตรียมข้อมูลสำหรับในการสมัครเอาไว้ให้เรียบร้อย ไม่ว่าจะเป็น เบอร์โทรศัพท์โทรศัพท์เคลื่อนที่ รหัส OTP ที่ได้รับ รหัสผ่านที่อยากใช้งาน บัญชีธนาคารพร้อมเลขบัญชีธนาคาร เพียงเท่านี้ ก็พร้อมสำหรับเพื่อการลงทะเบียนสมัครสมาชิกแล้วล่ะครับ ซึ่งคุณสามารถสมัครด้วยตัวเองได้เลย ไม่ต้องรอคอยแอดมินมาสมัครให้ สบาย เร็วทันใจ แล้วก็ไม่เป็นอันตรายแบบสุดๆแน่ๆ ลงทะเบียนเป็นสมาชิกแล้วมาสนุกสนานกันครับผม!

เป็นอย่างไรกันบ้างนะครับ ผมมั่นใจว่า หลังจากที่คุณได้อ่านเหตุผลต่างๆรวมถึงได้ทราบจะกับโปรโมชั่นดีๆจากพวกเราอย่างโปรโมชั่นฝากแรกของวัน คุณก็น่าจะพึงพอใจแล้วก็อยากทดลองสมัครสมาชิกใหม่กับเรา pgslot กันแล้วใช่ไหมล่ะครับ? หากคุณพอใจสมัครเป็นสมาชิกใหม่ล่ะก็ คุณสามารถเข้าไปสมัครเป็นสมาชิกที่หน้าเว็บไซต์pgslotของเราได้เลยนะขอรับ เพียงจัดเตรียมข้อมูลสำหรับในการสมัครเอาไว้ให้เรียบร้อย ไม่ว่าจะเป็น เบอร์โทรศัพท์โทรศัพท์เคลื่อนที่ รหัส OTP ที่ได้รับ รหัสผ่านที่อยากใช้งาน บัญชีธนาคารพร้อมเลขบัญชีธนาคาร เพียงเท่านี้ ก็พร้อมสำหรับเพื่อการลงทะเบียนสมัครสมาชิกแล้วล่ะครับ ซึ่งคุณสามารถสมัครด้วยตัวเองได้เลย ไม่ต้องรอคอยแอดมินมาสมัครให้ สบาย เร็วทันใจ แล้วก็ไม่เป็นอันตรายแบบสุดๆแน่ๆ ลงทะเบียนเป็นสมาชิกแล้วมาสนุกสนานกันครับผม!

5 เทคนิคการเล่นสล็อตออนไลน์กับ สล็อต ทำกำไรหลักหมื่นได้อย่างง่ายดาย มาลองกัน!

5 เทคนิคการเล่นสล็อตออนไลน์กับ สล็อต ทำกำไรหลักหมื่นได้อย่างง่ายดาย มาลองกัน! 1. ฝึกหัดเล่นในห้องทดลอง สล็อต

1. ฝึกหัดเล่นในห้องทดลอง สล็อต

pg99 เว็บตรงบริการสล็อตออนไลน์ประสิทธิภาพ ที่ได้รับความนิยมที่สุดในปี 2024

pg99 เว็บตรงบริการสล็อตออนไลน์ประสิทธิภาพ ที่ได้รับความนิยมที่สุดในปี 2024 เว็บบริกา

เว็บบริกา 1. รวมเกมสล็อตออนไลน์ค่ายดังยอดนิยม

1. รวมเกมสล็อตออนไลน์ค่ายดังยอดนิยม ดังนี้เว็บslotxoของเรายังมีบริการฯลฯที่คอยให้ทุกคนได้เข้าใช้บริการกันผ่านเว็บสล็อตแท้ ได้แล้ววันนี้ และสำหรับคนไหนกันที่ปรารถนาความสบายสบายสำหรับในการเล่นเกม โดยคุณสามารถดาวน์โหลดเดมมาเล่นบนมือถือได้แล้วทั้งยังระบบ IOS รวมทั้ง Android ตลอด 1 วัน เพียงแค่เสิร์ชคำว่า สล็อตxo สล็อตออนไลน์ download เพียงเท่านี้คุณก็จะสามารถโหลดเกมไปเล่นได้อย่างมีความสุข บอกได้คำเดียวว่าทั้งสนุกและสบายในการเล่นแบบงี้คุณจะพลาดไม่ได้ด้วยประการทั้งปวง

ดังนี้เว็บslotxoของเรายังมีบริการฯลฯที่คอยให้ทุกคนได้เข้าใช้บริการกันผ่านเว็บสล็อตแท้ ได้แล้ววันนี้ และสำหรับคนไหนกันที่ปรารถนาความสบายสบายสำหรับในการเล่นเกม โดยคุณสามารถดาวน์โหลดเดมมาเล่นบนมือถือได้แล้วทั้งยังระบบ IOS รวมทั้ง Android ตลอด 1 วัน เพียงแค่เสิร์ชคำว่า สล็อตxo สล็อตออนไลน์ download เพียงเท่านี้คุณก็จะสามารถโหลดเกมไปเล่นได้อย่างมีความสุข บอกได้คำเดียวว่าทั้งสนุกและสบายในการเล่นแบบงี้คุณจะพลาดไม่ได้ด้วยประการทั้งปวง slotxo เว็บตรง slotxo Slotxo24hr.fun 12 มีนา

slotxo เว็บตรง slotxo Slotxo24hr.fun 12 มีนา

• Fortune Ox (โคแห่งโชคลาภ) สำหรับเกม Fortune Ox หรือโคแห่งโชคลาภ นับว่าเป็นเกมยอดนิยมสูงมากมาย หน้าปกของเกมจะเป็นรูปพี่โคสุดหล่อสวมเสื้อสีแดงกำลังถือหยวนเป่าหรือเงินโบราณของจีนอยู่นั่นเองครับผม ซึ่งบอกเลยนะครับว่า การออกแบบคาแร็กเตอร์โคนำโชคของ fullslotpg นับว่าทำออกมาก้าวหน้ามากมายๆครับผม ซึ่งความเชื่อเรื่องวัวเป็นสัตว์มงคลนั้น ก็มาจากจีนเลยล่ะครับ เพราะว่าเป็นเครื่องหมายที่ผลผลิตที่ดีนั่นเอง โดยเกมนี้เป็นเกมสล็อตแบบ

• Fortune Ox (โคแห่งโชคลาภ) สำหรับเกม Fortune Ox หรือโคแห่งโชคลาภ นับว่าเป็นเกมยอดนิยมสูงมากมาย หน้าปกของเกมจะเป็นรูปพี่โคสุดหล่อสวมเสื้อสีแดงกำลังถือหยวนเป่าหรือเงินโบราณของจีนอยู่นั่นเองครับผม ซึ่งบอกเลยนะครับว่า การออกแบบคาแร็กเตอร์โคนำโชคของ fullslotpg นับว่าทำออกมาก้าวหน้ามากมายๆครับผม ซึ่งความเชื่อเรื่องวัวเป็นสัตว์มงคลนั้น ก็มาจากจีนเลยล่ะครับ เพราะว่าเป็นเครื่องหมายที่ผลผลิตที่ดีนั่นเอง โดยเกมนี้เป็นเกมสล็อตแบบ เริ่มต้นวันใหม่กับโปรโมชั่นโบนัสบิลแรกจาก fullslot กันไปเลย ฝากน้อยรับร้อยของแท้!

เริ่มต้นวันใหม่กับโปรโมชั่นโบนัสบิลแรกจาก fullslot กันไปเลย ฝากน้อยรับร้อยของแท้! ขอขอบพระคุณที่มา

ขอขอบพระคุณที่มา  พบกับความสนุกสนานร่าเริงรวมทั้งความบันเทิงจัดเต็มจาก PUNPRO777 เว็บไซต์ตรงมาตรฐานระดับนานาชาติ สมัครเลย!

พบกับความสนุกสนานร่าเริงรวมทั้งความบันเทิงจัดเต็มจาก PUNPRO777 เว็บไซต์ตรงมาตรฐานระดับนานาชาติ สมัครเลย! แค่ทำเงินจากการเล่นPgslotมันยังน้อยเกินไปนะครับ ถ้าเกิดคุณสามารถทำกำไรได้แล้วไม่สามารถที่จะถอนได้ มันคงเกิดเรื่องที่น่าหงุดหงิดใจไม่ใช่น้อยใช่ไหมล่ะนะครับ ลองใช้บริการกับเรา punpro ดูสิครับ! พวกเราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ มาตรฐานเว็บตรงสุดยอด ได้รับการรับรองรวมทั้งถือลิขสิทธิ์แท้ของค่ายเกมสล็อตออนไลน์ชั้นแนวหน้าระดับนานาชาติจำนวนมากกว่า 20 ค่าย กว่า 2,500 เกมที่เปิดให้บริการกับสมาชิกทุกท่าน ไม่พลาดทุกโปรโมชั่นแล้วก็กิจกรรมจำนวนมาก เว็บไซต์ตรงที่ดีที่สุดที่บอกเลยว่าคุณจะไม่ต้องมานั่งกังวลว่า เมื่อทำเงินได้แล้วไม่สามารถที่จะถอนได้ เนื่องจากว่าที่ punpro777 ไม่ว่าคุณจะถอนเท่าไหร่ก็สามารถถอนได้อย่างไม่ต้องสงสัยขอรับ สนุกกับการเล่นสล็อตออนไลน์ได้ทุกวี่วัน สมัครเลย!

แค่ทำเงินจากการเล่นPgslotมันยังน้อยเกินไปนะครับ ถ้าเกิดคุณสามารถทำกำไรได้แล้วไม่สามารถที่จะถอนได้ มันคงเกิดเรื่องที่น่าหงุดหงิดใจไม่ใช่น้อยใช่ไหมล่ะนะครับ ลองใช้บริการกับเรา punpro ดูสิครับ! พวกเราเป็นสล็อตเว็บตรงไม่ผ่านเอเย่นต์ มาตรฐานเว็บตรงสุดยอด ได้รับการรับรองรวมทั้งถือลิขสิทธิ์แท้ของค่ายเกมสล็อตออนไลน์ชั้นแนวหน้าระดับนานาชาติจำนวนมากกว่า 20 ค่าย กว่า 2,500 เกมที่เปิดให้บริการกับสมาชิกทุกท่าน ไม่พลาดทุกโปรโมชั่นแล้วก็กิจกรรมจำนวนมาก เว็บไซต์ตรงที่ดีที่สุดที่บอกเลยว่าคุณจะไม่ต้องมานั่งกังวลว่า เมื่อทำเงินได้แล้วไม่สามารถที่จะถอนได้ เนื่องจากว่าที่ punpro777 ไม่ว่าคุณจะถอนเท่าไหร่ก็สามารถถอนได้อย่างไม่ต้องสงสัยขอรับ สนุกกับการเล่นสล็อตออนไลน์ได้ทุกวี่วัน สมัครเลย! โดยเกม Dream of Macao เป็นเกมสล็อตแบบ 6 รีล 6 แถว มีไลน์เดิมพันที่ชนะสูงถึง 32,400 ไลน์เดิมพัน สามารถเบทได้ตั้งแต่ 1 บาท ไปจนถึงสูงสุดที่ 400 บาท ทั้งยังเกมนี้ยังสามารถซื้อฟีเจอร์ฟรีสปินได้อีกด้วยครับ บอกเลยว่า น่าจะถูกอกถูกใจกับแฟน PGSLOT กันแบบสุดๆเลยล่ะครับผม ในส่วนของอัตราการจ่ายเงินรางวัลนั้น มีอัตรการชำระเงินรางวัลสูงสุดอยู่ที่ 80 เท่า ซึ่งจัดว่าสูงมากมายๆครับผม และในส่วนของฟีเจอร์ต่างๆก็ยังมีมากไม่น้อยเลยทีเดียวอีกด้วย ไม่ว่าจะเป็นฟีพบร์ Wild กำลังเดินทางมาแบบเหนียวหนึบ ที่จะช่วยให้คุณได้สัญลักษณ์ Wild ง่ายยิ่งขึ้น,

โดยเกม Dream of Macao เป็นเกมสล็อตแบบ 6 รีล 6 แถว มีไลน์เดิมพันที่ชนะสูงถึง 32,400 ไลน์เดิมพัน สามารถเบทได้ตั้งแต่ 1 บาท ไปจนถึงสูงสุดที่ 400 บาท ทั้งยังเกมนี้ยังสามารถซื้อฟีเจอร์ฟรีสปินได้อีกด้วยครับ บอกเลยว่า น่าจะถูกอกถูกใจกับแฟน PGSLOT กันแบบสุดๆเลยล่ะครับผม ในส่วนของอัตราการจ่ายเงินรางวัลนั้น มีอัตรการชำระเงินรางวัลสูงสุดอยู่ที่ 80 เท่า ซึ่งจัดว่าสูงมากมายๆครับผม และในส่วนของฟีเจอร์ต่างๆก็ยังมีมากไม่น้อยเลยทีเดียวอีกด้วย ไม่ว่าจะเป็นฟีพบร์ Wild กำลังเดินทางมาแบบเหนียวหนึบ ที่จะช่วยให้คุณได้สัญลักษณ์ Wild ง่ายยิ่งขึ้น,

• สูตร 50 ลบ 5 :

• สูตร 50 ลบ 5 :  ขอขอบพระคุณที่มา

ขอขอบพระคุณที่มา

เว็บเล่น pg เปิดใหม่พร้อมให้บริการ สาวก pg เตรียมความพร้อม!

เว็บเล่น pg เปิดใหม่พร้อมให้บริการ สาวก pg เตรียมความพร้อม! • เว็บไซต์ slog ของพวกเรา จำต้องผ่านการคัดเลือกจากเว็บไซต์สล็อตออนไลน์จำนวนมากทั่วโลกที่สมัครสมาชิกตรวจตราคุณลักษณะเว็บไซต์ เพื่อจะขึ้นเป็น สล็อตเว็บตรง อย่างถูกต้อง

• เว็บไซต์ slog ของพวกเรา จำต้องผ่านการคัดเลือกจากเว็บไซต์สล็อตออนไลน์จำนวนมากทั่วโลกที่สมัครสมาชิกตรวจตราคุณลักษณะเว็บไซต์ เพื่อจะขึ้นเป็น สล็อตเว็บตรง อย่างถูกต้อง • เว็บที่กำลังจะได้เป็น สล็อต เว็บไซต์ตรง จะต้องมีความปลอดภัยในระดับมาตรฐาน รวมทั้งได้รับการรับรองความปลอดภัยจากหน่วยงานต่างๆของทีมคาสิโนสากล เพื่อดูว่าเหมาะสมจะเป็นเว็บไซต์ที่ได้รับชื่อ สล็อตเว็บตรง หรือเปล่า โดยความปลอดภัยจะมี 3 หัวข้อสำหรับการสำรวจหลักๆซึ่งก็คือ

• เว็บที่กำลังจะได้เป็น สล็อต เว็บไซต์ตรง จะต้องมีความปลอดภัยในระดับมาตรฐาน รวมทั้งได้รับการรับรองความปลอดภัยจากหน่วยงานต่างๆของทีมคาสิโนสากล เพื่อดูว่าเหมาะสมจะเป็นเว็บไซต์ที่ได้รับชื่อ สล็อตเว็บตรง หรือเปล่า โดยความปลอดภัยจะมี 3 หัวข้อสำหรับการสำรวจหลักๆซึ่งก็คือ เว็บไซต์ดูหนังผ่านอินเตอร์เน็ตรายปี 2024 จัดเต็มทุกหนังเด็ด ซีรีส์ดัง ห้ามพลาดโดยเด็ดขาด!

เว็บไซต์ดูหนังผ่านอินเตอร์เน็ตรายปี 2024 จัดเต็มทุกหนังเด็ด ซีรีส์ดัง ห้ามพลาดโดยเด็ดขาด! เติบเต็มทุกความเบิกบานใจของคุณไม่รู้จบ กับการดูหนังออนไลน์บนเว็บ

เติบเต็มทุกความเบิกบานใจของคุณไม่รู้จบ กับการดูหนังออนไลน์บนเว็บ  อย่าอายคนใดที่จะกล่าวว่าพวกเราถูกใจดูหนังการ์ตูน ถึงตัวจะเป็นผู้ใหญ่ แม้กระนั้นหัวใจของเราเด็กเสมอ

อย่าอายคนใดที่จะกล่าวว่าพวกเราถูกใจดูหนังการ์ตูน ถึงตัวจะเป็นผู้ใหญ่ แม้กระนั้นหัวใจของเราเด็กเสมอ

ตามหาเว็บไซต์ดูหนังออนไลน์ ตามหาพวกเรา ดูหนัง สิครับผม! พวกเราเป็นเว็บดูหนังออนไลน์ที่พร้อมมอบความบันเทิงและประสบการณ์การดูหนังที่ไม่มีใครเหมือน พวกเราจัดเต็มอีกทั้งหนังเด็ด ซีรีส์ดัง และก็อีกเยอะแยะ ให้ท่านสนุกสนานกับการรับดูความสนุกสนานร่าเริงได้แบบไม่สิ้นสุด หนังใหม่ชนโรง หนังเก่าที่นึกถึง หรือหนังหาดูยาก ก็สามารถมาดูกับเราได้เลยคะครับ ไม่ต้องลงทะเบียนเป็นสมาชิก สามารถมองได้ในทันที บอกเลยว่า ฟินต้อนรับวันหยุดแน่ๆ

ตามหาเว็บไซต์ดูหนังออนไลน์ ตามหาพวกเรา ดูหนัง สิครับผม! พวกเราเป็นเว็บดูหนังออนไลน์ที่พร้อมมอบความบันเทิงและประสบการณ์การดูหนังที่ไม่มีใครเหมือน พวกเราจัดเต็มอีกทั้งหนังเด็ด ซีรีส์ดัง และก็อีกเยอะแยะ ให้ท่านสนุกสนานกับการรับดูความสนุกสนานร่าเริงได้แบบไม่สิ้นสุด หนังใหม่ชนโรง หนังเก่าที่นึกถึง หรือหนังหาดูยาก ก็สามารถมาดูกับเราได้เลยคะครับ ไม่ต้องลงทะเบียนเป็นสมาชิก สามารถมองได้ในทันที บอกเลยว่า ฟินต้อนรับวันหยุดแน่ๆ 4 หัวใจสำคัญสำหรับในการเลือกใช้บริการกับเว็บไซต์สล็อตออนไลน์สไตล์ pg

4 หัวใจสำคัญสำหรับในการเลือกใช้บริการกับเว็บไซต์สล็อตออนไลน์สไตล์ pg 4. ระบบบริการข้างหลังบ้านตลอด 24 ชั่วโมง

4. ระบบบริการข้างหลังบ้านตลอด 24 ชั่วโมง ลงทะเบียนสมัครสมาชิกกับพวกเราได้แล้ววันนี้ สมัครฟรีไม่ต้องจ่ายเงินอะไรก็แล้วแต่ทั้งปวง สมัครเลยกับ PG77

ลงทะเบียนสมัครสมาชิกกับพวกเราได้แล้ววันนี้ สมัครฟรีไม่ต้องจ่ายเงินอะไรก็แล้วแต่ทั้งปวง สมัครเลยกับ PG77

แหล่งรวมค่ายเกม สล็อตเว็บตรง รวมทั้งเกมใหม่ เล่นได้ไม่ยั้ง ตลอด 1 วัน

แหล่งรวมค่ายเกม สล็อตเว็บตรง รวมทั้งเกมใหม่ เล่นได้ไม่ยั้ง ตลอด 1 วัน ด้วยเหตุดังกล่าว ก็เลยสามารถสรุปได้ว่า นี่เป็น แหล่งให้บริการ สล็อตเว็บตรง ที่มีเกมมากมายก่ายกอง นานาประการ รูปแบบ และพร้อมอัพเดทอะไรใหม่ๆสุดแสนพิเศษ จัดหนัก จัดเต็ม กว่าที่คุณคิด เป็นปรากฏการณ์ ทางด้านการลงทุน ที่คุ้ม เป็นคุณภาพ ทางด้านแนวทางการทำเงิน ที่สุดยอด รวมทั้งยังคงพร้อมมอบอะไร ใหม่ๆที่พิเศษมากกว่าเดิม ให้แด่ท่านได้ อย่างจัดเต็ม เป็นอะไรใหม่ๆที่พร้อมเปิดประสบการณ์ โดยตรงกับ ทุกแบบประสบการณ์ใหม่ๆที่ดี มีสาระ และพร้อมเปิดประสบการณ์ สล็อตเว็บตรง ที่แจ่มแจ้ง กว่าที่คุณคิด ซึ่งแน่นอนว่า ดีที่สุด

ด้วยเหตุดังกล่าว ก็เลยสามารถสรุปได้ว่า นี่เป็น แหล่งให้บริการ สล็อตเว็บตรง ที่มีเกมมากมายก่ายกอง นานาประการ รูปแบบ และพร้อมอัพเดทอะไรใหม่ๆสุดแสนพิเศษ จัดหนัก จัดเต็ม กว่าที่คุณคิด เป็นปรากฏการณ์ ทางด้านการลงทุน ที่คุ้ม เป็นคุณภาพ ทางด้านแนวทางการทำเงิน ที่สุดยอด รวมทั้งยังคงพร้อมมอบอะไร ใหม่ๆที่พิเศษมากกว่าเดิม ให้แด่ท่านได้ อย่างจัดเต็ม เป็นอะไรใหม่ๆที่พร้อมเปิดประสบการณ์ โดยตรงกับ ทุกแบบประสบการณ์ใหม่ๆที่ดี มีสาระ และพร้อมเปิดประสบการณ์ สล็อตเว็บตรง ที่แจ่มแจ้ง กว่าที่คุณคิด ซึ่งแน่นอนว่า ดีที่สุด

All-in-One Platform สำหรับบริการ All-in-One Platformที่พวกเรา เปิดเว็บพนัน hyperxtech นั้น จะเป็นลักษณะของบริการเปิดเว็บพนันเต็มรูปแบบสำหรับผู้ที่มึความสนใจอยากเริ่มต้นเปิดเว็บ โดยสามารถมาใช้บริการกับพวกเราได้ โดยคุณจะได้รับสิทธิพิเศษเยอะมาก ไม่ว่าจะเป็น การเปิดให้บริการแบบครบวงจร จบในเว็บไซต์เดียวแน่นอนครับผม สล็อต คาสิโน กีฬา หรือหวย ก็มีให้ครบ มีเกมหรือคาสิโนมากกว่า 120 ค่าย กล่าวได้ว่า จัดเต็มทุกต้นแบบแน่นอน ทำกำไรกับการเปิดเว็บได้แบบยาวๆรายได้หลักสิบล้านบาทต่อเดือนได้อย่างง่ายๆ โดยมีราคาเริ่มต้นกับ Standard Package ที่

All-in-One Platform สำหรับบริการ All-in-One Platformที่พวกเรา เปิดเว็บพนัน hyperxtech นั้น จะเป็นลักษณะของบริการเปิดเว็บพนันเต็มรูปแบบสำหรับผู้ที่มึความสนใจอยากเริ่มต้นเปิดเว็บ โดยสามารถมาใช้บริการกับพวกเราได้ โดยคุณจะได้รับสิทธิพิเศษเยอะมาก ไม่ว่าจะเป็น การเปิดให้บริการแบบครบวงจร จบในเว็บไซต์เดียวแน่นอนครับผม สล็อต คาสิโน กีฬา หรือหวย ก็มีให้ครบ มีเกมหรือคาสิโนมากกว่า 120 ค่าย กล่าวได้ว่า จัดเต็มทุกต้นแบบแน่นอน ทำกำไรกับการเปิดเว็บได้แบบยาวๆรายได้หลักสิบล้านบาทต่อเดือนได้อย่างง่ายๆ โดยมีราคาเริ่มต้นกับ Standard Package ที่

• ณ ในตอนนี้ค่ายนี้เป็นเยี่ยมในค่ายสล็อตออนไลน์ลำดับต้นๆของโลก รวมทั้งขึ้นแท่นชั้น 1 ชั่วนิจนิรันดร์ในเอเชีย

• ณ ในตอนนี้ค่ายนี้เป็นเยี่ยมในค่ายสล็อตออนไลน์ลำดับต้นๆของโลก รวมทั้งขึ้นแท่นชั้น 1 ชั่วนิจนิรันดร์ในเอเชีย • ตั้งแต่ปี 2022-2024 ค่าย 1xbet เป็นค่ายสล็อตออนไลน์ที่ได้รับการรชการันตีว่า เป็นหนึ่งในค่ายเกม สล็อต ยอดนิยมสูงสุด และมีผู้ใช้บริการมากที่สุดเป็นชั้น 1 ของโลกจนถึงในเดี๋ยวนี้

• ตั้งแต่ปี 2022-2024 ค่าย 1xbet เป็นค่ายสล็อตออนไลน์ที่ได้รับการรชการันตีว่า เป็นหนึ่งในค่ายเกม สล็อต ยอดนิยมสูงสุด และมีผู้ใช้บริการมากที่สุดเป็นชั้น 1 ของโลกจนถึงในเดี๋ยวนี้

1. เช็คชื่อรับเครดิตฟรี เช็คครบ 3 วัน เอาไปเลย 100 เครดิต 10 วันอีก 400 21 วันรับเครดิตฟรีต่ออีก 700 เช็คอินครบ 30 วัน รับเครดิตฟรีไปเลย 1000 เครดิต! เข้มๆโปรนี้เป็นที่ได้รับความนิยมในคาสิโนสดของ บาคาร่า168 มากมายๆแรง เหล่านักเสี่ยงดวง บาคาร่า มากไม่น้อยเลยทีเดียวบอกเลยว่า โปรโมชั่นนี้คุ้มที่สุดแล้ว แค่ login!

1. เช็คชื่อรับเครดิตฟรี เช็คครบ 3 วัน เอาไปเลย 100 เครดิต 10 วันอีก 400 21 วันรับเครดิตฟรีต่ออีก 700 เช็คอินครบ 30 วัน รับเครดิตฟรีไปเลย 1000 เครดิต! เข้มๆโปรนี้เป็นที่ได้รับความนิยมในคาสิโนสดของ บาคาร่า168 มากมายๆแรง เหล่านักเสี่ยงดวง บาคาร่า มากไม่น้อยเลยทีเดียวบอกเลยว่า โปรโมชั่นนี้คุ้มที่สุดแล้ว แค่ login! • ลงทะเบียนเสร็จแล้วแอดไลน์ของเว็บไซต์ บาคาร่า ไว้รับข่าวได้เลยจ๊า

• ลงทะเบียนเสร็จแล้วแอดไลน์ของเว็บไซต์ บาคาร่า ไว้รับข่าวได้เลยจ๊า

เว็บไซต์จากเครือ สล็อต

เว็บไซต์จากเครือ สล็อต  • เรา slotxo เว็บตรงไม่ผ่านเอเย่นต์ ของจริงจาก สล็อต ขอให้ทุกท่านเชื่อถือว่า สำหรับเพื่อการกลับมาของเราในครั้งนี้ จะสร้างแรงสั่นสะเทือนวงการสล็อตไทยได้อย่างแน่แท้

• เรา slotxo เว็บตรงไม่ผ่านเอเย่นต์ ของจริงจาก สล็อต ขอให้ทุกท่านเชื่อถือว่า สำหรับเพื่อการกลับมาของเราในครั้งนี้ จะสร้างแรงสั่นสะเทือนวงการสล็อตไทยได้อย่างแน่แท้